Choose Your Hard: Why the American Dream of Homeownership is Alive and Well. What is your "Personal Philosophy?"

WOW, we made it. By the time you read this, the election will be over! Some of us are happy, and some are disappointed. But I am getting older, and I can tell you the sun will come up tomorrow. If you need proof, visit Bluff Drive around 6:45 a.m. or check out the Isle of Hope Neighborhood Facebook Page. Guaranteed, one of our neighborhood, early-rising photographers will post a sunrise picture of our beautiful island! No matter who wins, our lives will go on. Now, it is up to your “PERSONAL PHILOSOPHY” on whether you will thrive or wither in the wake of the results. I have participated in 11 presidential elections, and under EVERY one of them, I have made more money than the one before and been better off over time! Why? My philosophy. If it’s to be, it’s up to me!

As a real estate agent I hear a lot that the American Dream of homeownership is dead or dying. Not true! You have to ask yourself, what is your “Personal Philosophy”? What do you believe in? Is your glass half empty or full? As my grandfather used to say, when things get hard, do you “cry in your beer” or make things happen for you and your family? Control what we can control! Currently, rates are high, making buying a home seem impossible, with rates on car loans between 5% to 19% and average credit card rates at 25.37%. What can you do? It is hard, but you can choose your hard!

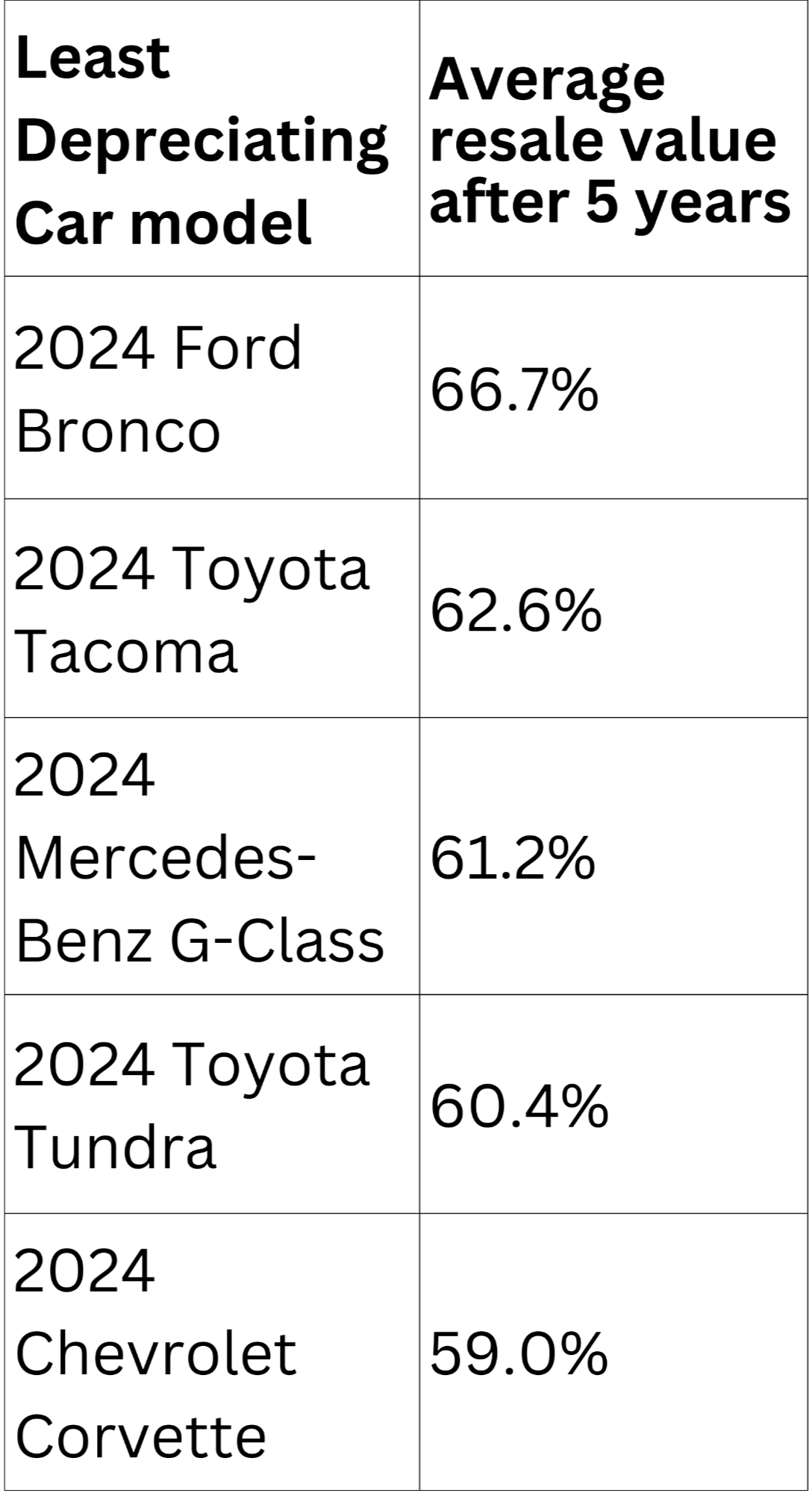

For example, today's average car payment is $732 per month. Now, include insurance and gas, and add $217 for insurance and $200 for gas and maintenance. On average, driving a new car costs a whopping $1,149 a month! If that is not crazy enough, the average vehicle depreciates over 60% over 5 years. Below is a chart of the least depreciating car models: At about $100k, you only lose $40k on that new Corvette or lose only $22k if you buy a new Bronco. And listen, these are the cars with the least depreciation! One of the worst is the Audi A7, which loses almost 60% of its value. A new one will set you back about $70k. In 5 years, you will lose $42,000!

Invest in things that increase in value, and STOP buying stupid SH#T! Do you need a NEW car? You need a reliable used car to get you to and from work, not a car to flex on the people who see you driving your new money pit! EVERYONE needs a roof over their head! My advice for families is to keep your kids at home as long as possible so they can save enough money to buy their first house! Set their goal to move out once they can afford a downpayment. Now your first house will not be on Bluff Drive, but you can still find a nice home in a nice neighborhood as your first home! It is not your DREAM home but your first home, where you can watch some YouTube videos to learn how to do fixer-upper projects to increase your equity and trade up in 5 to 10 years!

Remember above: “It is hard, but you can choose hard!” It’s hard to save money. It's hard to say no to the millions of temptations in the world that are begging you to waste your money. It's hard to drive an older car when everyone has a new one. It's hard to take your lunch to work when everyone goes out! It's hard to eat at home when everyone is on Instagram, showing off all the fancy places they eat! But I have seen it with my own two eyes—dozens and dozens of clients who make the hard choices early in life, only to cash out big when they sell their homes! Right now, there are 5 or 6 homes for sale on IOH, and the owners will make almost double their money since they bought their homes! Some will bank more than that! Because rent is like paying 100% interest—you see nothing in return!

Now, I can hear the critics finding things to argue about, and that’s to be expected. Ultimately, this comes down to your “PERSONAL PHILOSOPHY.” If you disagree, that’s okay—good luck renting and setting your hard-earned money on fire. My advice to home buyers is to find a home in an area you love—not necessarily a perfect home, but a neighborhood or community that feels right. Start with what you can afford, and make small improvements over time. By putting in the work, you’ll see your home’s value and your equity grow steadily, transforming your investment into something truly life-changing.

Categories

Recent Posts

GET MORE INFORMATION